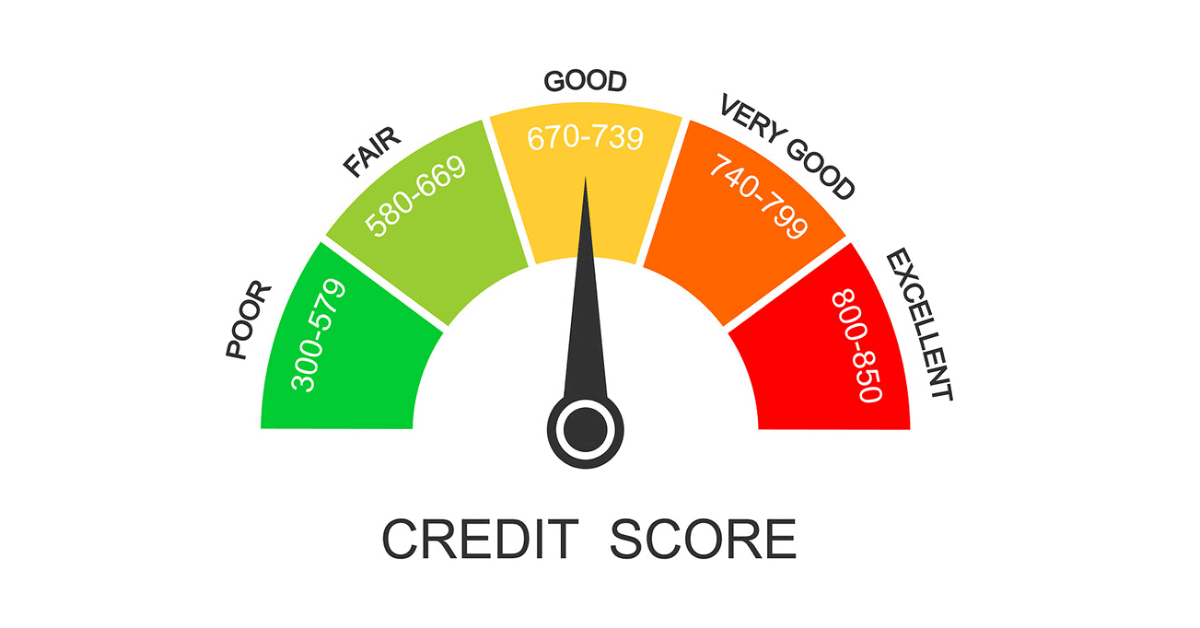

CIBIL score is the most important part of your credit report. Banks and other financial institutions check it before giving you credit cards or loans. Understanding, monitoring, and managing your credit score is essential to increase your chances for loan approvals. There are multiple ways to check your CIBIL score, including using a PAN card. This article outlines how to do a CIBIL score check online with a PAN card.

Importance of a PAN Card in a Credit Report

A PAN card has a unique 10-digit alphanumeric number. It is issued to any tax-paying individual to track their financial transactions. When you open a bank or any other financial account, your PAN card is directly linked to it.

Since your PAN card is linked to your accounts, any financial transaction you make is logged against your unique PAN number. All these logs maintained against your PAN card allow Credit Information Companies (CICs) and credit bureaus to locate all your details easily.

How to Check CIBIL Score Online Using Your PAN Card Number

There are two ways to do a CIBIL score check online with a PAN card: from CIBIL’s official website or its authorised partner’s website. In both cases, the steps are usually the same. Here’s how to check CIBIL score with a PAN card:

- Visit the official CIBIL website or TransUnion CIBIL’s authorised partner websites, such as the one of Bajaj Markets.

- Select the “Get Your Free CIBIL Score” option.

- Add your basic personal information. This can include your first and last name, registered mobile number, email ID, date of birth, etc.

- Select “PAN” as the ID type and enter your PAN number.

- Click on the “Accept and Continue” button to proceed.

One thing to note here is that you will only get a free CIBIL score through these steps. Suppose you want to get a complete credit report, which includes additional information like your credit history, public information about you, inquiry information, etc. In that case, you will have to subscribe to CIBIL’s website. TransUnion CIBIL offers three subscription plans: basic, standard, and premium. You can choose any of them based on your requirements.

Does a PAN Card Replacement Affects Your CIBIL Score

If your PAN card is lost, stolen, or damaged, you can request a duplicate PAN card. In this case, the unique alphanumeric identification number will be the same as on your original PAN card. Since all your previous transactions are mapped against this unique PAN card number, requesting a duplicate PAN card won’t affect your credit score.

Importance of Checking CIBIL Score Regularly

Doing a CIBIL score check online with a PAN card is important to stay informed about your credit health. Here are some benefits of regularly checking your CIBIL score:

- It helps you make informed financial decisions.

- Aids in detecting any errors in your credit report.

- Allows you to assess your eligibility for credit cards and loans.

- It helps you plan your financial goals strategically.

- It gives you an idea of how you can improve or maintain your credit score.

It is important to note that although important, these checks should not be too frequent. Too many credit score checks within a short period can have a negative impact on your CIBIL score. Besides knowing how to check your CIBIL score, you should also learn how to interpret it, otherwise it won’t be useful. This makes understanding the factors influencing your CIBIL score essential. This will enable you to take the right action to increase it.

Factors Influencing Your CIBIL Score

TransUnion CIBIL calculates your credit score based on numerous factors like payment history, credit utilisation ratio, etc. Here are some factors to keep in mind:

Delaying Payments

Irresponsible payment behavior remains the main influence which affects your CIBIL score. Non-payment of loans together with credit card bills and every other type of EMI leads to lower CIBIL score ratings. On-time repayment activities will support your credit score alongside boosting possibilities to obtain new credit cards or loans.

Many credit applications submitted closely together

Before issuing a credit product to customers the lender assesses their credit record during application procedures. A credit account inquiry known as hard inquiry happens when this process takes place. Quickly seeking multiple new credits shows an excessive desire for borrowing thus casting doubt on your ability to pay back loans.

High Credit Utilisation Ratio

Your available credit measurement depends on the credit utilisation ratio model. The maximum amount of available credit you should employ is thirty percent. You possess two credit cards that provide ₹1,50,000 and ₹2,50,000 as their respective monthly limits. The total amount of available credit provided to you is ₹4,00,000 per month. The permitted usage of available credit should not exceed ₹1,20,000 since this corresponds to 30% of the complete credit limit. The score of your CIBIL can suffer when you use excessive amounts of your available credit throughout several months.

Diverse Credit Mix

Getting both secured and unsecured financial agreements within your credit report will create beneficial effects on your CIBIL score. The positive effects you want to achieve will require you to make full and prompt payments of all your debts.

Conclusion

You should learn how to view your CIBIL score through the internet using your PAN card because it benefits your financial situation. A view of your credit score becomes available free of charge through PAN card information while additional security measures protect your identity because the PAN card number remains known only to you. Regular credit report review enables you to monitor your CIBIL score while you enhance your eligibility for loans.

Frequently Asked Questions

Does my CIBIL score get affected when I update my PAN card?

No, your CIBIL score is mapped against your unique PAN card number, which is not changed even when you apply for a duplicate PAN card.

Will I have to pay a fee to check my CIBIL score online using my PAN card?

You don’t have to pay a fee to check your CIBIL score online using a PAN card. However, you might have to pay a small subscription fee to access your credit report.

What CIBIL score does a newly issued PAN card have?

CIBIL score is not associated with a PAN card, but the user in the name of whom it has been issued. A newly issued PAN card, therefore, does not have a CIBIL score since there is no credit history associated. Having a PAN card is usually mandatory when applying for any credit. So, if you don’t have a PAN card or are applying for any credit for the first time, you won’t have any credit history. Therefore, credit bureaus will not be able to calculate your CIBIL score.

Can I check my CIBIL score online if I don’t have a PAN card?

You can check your credit score online even if you don’t have a PAN card using other identity proofs like passport number, voter’s ID number, driver’s licence number, or ration card number.

Can I check my CIBIL score using PAN 2.0?

PAN 2.0 is just an updated version of the traditional PAN card. The new PAN 2.0 has a QR code that directly verifies PAN card details against the Income Tax Department’s database. Since the PAN number does not change in PAN 2.0, it can be used just like the regular PAN, for CIBIL checks.

If I lose my PAN card, will it affect my CIBIL score?

Losing your PAN card won’t affect your credit score. You can apply for a duplicate PAN card and access your CIBIL score as the PAN number does not change.

Can I have more than one PAN card?

Having multiple PAN cards with different alphanumeric codes is a punishable offence. According to Section 272B of the Income Tax Act, 1961, a person having more than one PAN card is liable for a penalty of ₹10,000. If someone is allotted multiple PAN cards due to any error, they should return it to the appropriate authority with immediate effect.